All Categories

Featured

Table of Contents

- – Five-Star Accredited Investor Real Estate Inve...

- – Professional Accredited Investor Platforms

- – Personalized Passive Income For Accredited In...

- – Innovative Accredited Investor Investment Ret...

- – World-Class Exclusive Deals For Accredited I...

- – High-Growth Private Placements For Accredite...

- – Exclusive Accredited Investor Financial Grow...

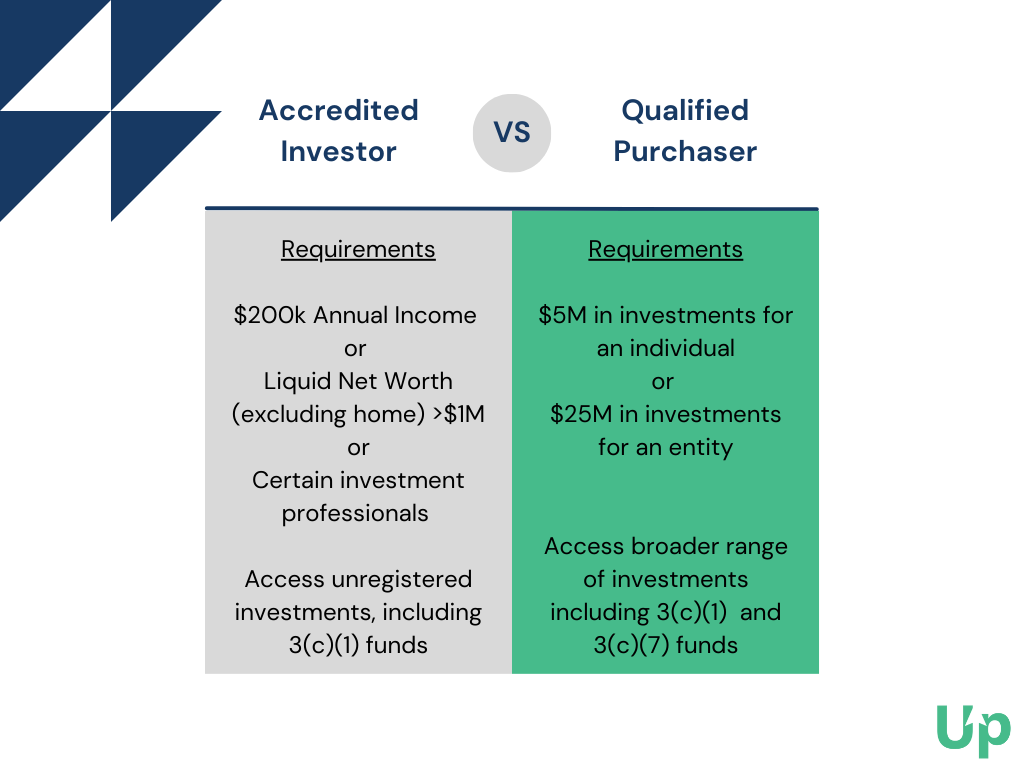

The policies for certified investors vary among jurisdictions. In the U.S, the definition of a recognized financier is placed forth by the SEC in Rule 501 of Law D. To be a certified capitalist, an individual must have a yearly revenue exceeding $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of gaining the exact same or a higher earnings in the present year.

This quantity can not consist of a key house., executive officers, or supervisors of a company that is providing non listed protections.

Five-Star Accredited Investor Real Estate Investment Networks

If an entity consists of equity proprietors who are approved investors, the entity itself is a certified capitalist. A company can not be created with the single purpose of acquiring details securities. An individual can certify as an approved financier by demonstrating adequate education or work experience in the financial sector

Individuals that wish to be certified capitalists do not relate to the SEC for the designation. Instead, it is the responsibility of the business providing an exclusive positioning to ensure that all of those come close to are recognized capitalists. Individuals or parties that wish to be approved investors can come close to the company of the unregistered protections.

For instance, expect there is an individual whose revenue was $150,000 for the last three years. They reported a main home value of $1 million (with a home mortgage of $200,000), a vehicle worth $100,000 (with an exceptional financing of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Net worth is calculated as assets minus obligations. He or she's total assets is precisely $1 million. This includes a calculation of their properties (various other than their key house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equaling $50,000. Given that they satisfy the total assets requirement, they certify to be a certified financier.

Professional Accredited Investor Platforms

There are a couple of less usual qualifications, such as handling a trust with greater than $5 million in properties. Under government securities legislations, just those that are accredited financiers may get involved in specific securities offerings. These may include shares in personal placements, structured products, and private equity or hedge funds, amongst others.

The regulators desire to be particular that individuals in these very risky and complex investments can look after themselves and evaluate the dangers in the lack of federal government defense. The certified capitalist rules are made to safeguard prospective financiers with limited financial knowledge from adventures and losses they might be ill furnished to stand up to.

Certified investors satisfy credentials and specialist standards to gain access to special investment possibilities. Certified investors have to fulfill income and web well worth demands, unlike non-accredited people, and can spend without restrictions.

Personalized Passive Income For Accredited Investors

Some key adjustments made in 2020 by the SEC consist of:. Consisting of the Collection 7 Collection 65, and Series 82 licenses or various other qualifications that reveal economic knowledge. This modification identifies that these entity kinds are frequently made use of for making investments. This change acknowledges the knowledge that these staff members create.

This modification represent the effects of inflation in time. These modifications expand the accredited financier swimming pool by approximately 64 million Americans. This wider accessibility offers much more chances for investors, yet likewise boosts prospective dangers as less economically advanced, financiers can take part. Businesses making use of personal offerings may benefit from a bigger swimming pool of potential financiers.

These financial investment options are unique to certified capitalists and organizations that certify as an approved, per SEC policies. This provides accredited capitalists the opportunity to invest in emerging companies at a stage prior to they take into consideration going public.

Innovative Accredited Investor Investment Returns

They are considered as financial investments and are accessible only, to certified clients. In addition to recognized firms, qualified investors can choose to invest in startups and promising ventures. This supplies them tax returns and the opportunity to go into at an earlier stage and potentially reap rewards if the company thrives.

However, for financiers available to the dangers involved, backing start-ups can lead to gains. A number of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage start-ups sustained by recognized angel capitalists. Innovative investors have the chance to check out financial investment alternatives that might produce much more profits than what public markets provide

World-Class Exclusive Deals For Accredited Investors

Although returns are not guaranteed, diversity and portfolio improvement alternatives are increased for capitalists. By diversifying their profiles with these expanded financial investment opportunities accredited capitalists can enhance their techniques and potentially attain exceptional long-lasting returns with appropriate danger administration. Seasoned financiers typically experience investment alternatives that may not be conveniently offered to the basic capitalist.

Investment choices and safeties used to recognized capitalists generally entail greater threats. As an example, private equity, equity capital and bush funds often concentrate on investing in properties that carry threat however can be sold off conveniently for the possibility of better returns on those dangerous financial investments. Researching before investing is critical these in circumstances.

Lock up durations stop capitalists from taking out funds for more months and years on end. There is likewise far much less transparency and governing oversight of exclusive funds contrasted to public markets. Financiers might struggle to precisely value private possessions. When dealing with dangers accredited financiers require to analyze any exclusive investments and the fund managers entailed.

High-Growth Private Placements For Accredited Investors for Expanding Investment Opportunities

This adjustment may prolong accredited financier standing to an array of people. Permitting companions in fully commited relationships to combine their resources for common qualification as recognized financiers.

Enabling people with certain specialist accreditations, such as Series 7 or CFA, to certify as certified capitalists. Creating added demands such as evidence of economic proficiency or effectively finishing an accredited capitalist test.

On the various other hand, it might additionally lead to seasoned financiers thinking too much threats that might not be suitable for them. So, safeguards may be required. Existing recognized financiers may deal with boosted competitors for the very best investment possibilities if the pool grows. Business elevating funds may gain from an expanded accredited investor base to draw from.

Exclusive Accredited Investor Financial Growth Opportunities

Those that are currently considered recognized investors must stay upgraded on any alterations to the requirements and policies. Businesses looking for recognized capitalists should stay vigilant regarding these updates to guarantee they are attracting the best audience of investors.

Table of Contents

- – Five-Star Accredited Investor Real Estate Inve...

- – Professional Accredited Investor Platforms

- – Personalized Passive Income For Accredited In...

- – Innovative Accredited Investor Investment Ret...

- – World-Class Exclusive Deals For Accredited I...

- – High-Growth Private Placements For Accredite...

- – Exclusive Accredited Investor Financial Grow...

Latest Posts

Investing In Tax Liens Risks

Best Books On Tax Lien Investing

Back Taxes Real Estate

More

Latest Posts

Investing In Tax Liens Risks

Best Books On Tax Lien Investing

Back Taxes Real Estate